Where will Robinhood’s stock be in 5 years?

The brokerage disruptor is now one of the world’s largest financial services companies.

Robbration markets (HOOD -0.73%)) is now one of the largest financial service companies in the world. To say that a decade ago would have seemed absurd. However, today, the broker at reduced prices focused on mobile trading has a market capitalization of $ 108 billion, approaching its competitors such as Charles Schwab And some of the large inherited banks. Its stock increased by 440% in the last 12 months.

With an easy -to -use application, growing features and robust cashback offers, Robinhood is increasing in net deposits for its brokerage and financial services. But what opportunities has Robinhood left? Let’s try to project where Robinhood’s stock will be in five years and if it is a purchase today.

Increase in user penetration

If you look at Robinhood’s growth in customers financed by the total, it may not seem to be a hyperprow business. During the 2021 stock market market, the broker culminated between 22 million and 23 million customers. In 2022 and 2023, its customer level did not increase with the stock market for stocks. Today, total customers have started to increase again – reaching 26.5 million in the second quarter – but the number is not much higher than it was 2021.

However, it is not the total number of Robinhood customers that stimulates financial growth, but growing penetration for the financial services of existing users. Robinhood’s total assets on the platform went from only $ 100 billion to the top in 2021 to 300 billion dollars last month, which means that customer deposits have quickly increased in recent years. More deposits mean more client negotiations, which leads to more income.

Robinhood Premium Services also continue to grow. Robinhood Gold, a subscription that costs $ 5 per month and offers better advantages such as high interest rates on deposits and better instant deposits, reached 3.48 million subscribers in the last quarter. 13.1% of customers now use Robinhood Gold, compared to 8.2% in the same quarter a year ago.

Image source: Getty Images.

Surfing the market wave

As a stock, cryptocurrency options and brokerage, Robinhood’s activities will do the investment cycle. If the shares drop, its total assets in custody will drop, resulting in a drop in income and interest income. As the opposite occurs, its income will start growing again.

We can see this trend in its long -term income table. Robinhood’s revenues increased in 2020 and 2021. It took a break in 2022 and 2023, and began to climb to peaks of all time in the last quarters. Taking long opinion, Robinhood’s revenues have increased by more than 1,000% since 2020, making it one of the financial services companies that increase the world in the world.

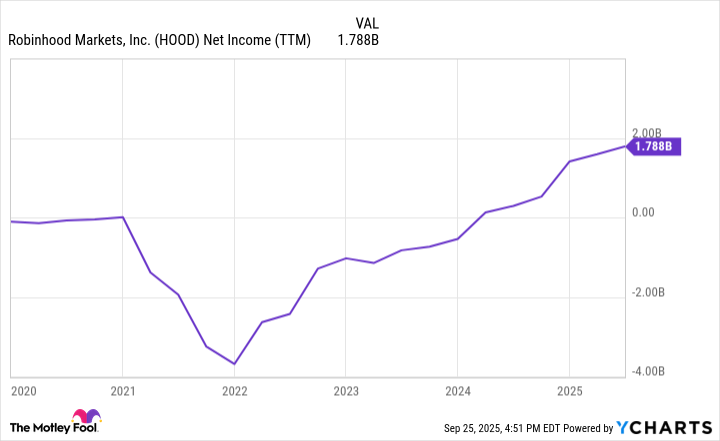

At the same time, Robinhood finally turns a basic profit. The company underwent a net loss of more than $ 2 billion in 2022. In the past 12 months, it had a positive net income of $ 1.78 billion. This puts robination on a solid financial basis and proves that the brokerage model at reduced prices with free commissions can operate on a large scale. Investors should close this net income figure to see how it changes when the market inevitably goes through a slowdown.

Net cover income data (TTM) by Ycharts.

Where will Robinhood’s stock be in five years?

To determine where Robinhood’s actions will be negotiated in five years is not easy. On the one hand, the financial performance of the company will at least somewhat reflect the path of the stock market. If the stock market enters withdrawn at a given time in the next five years – the bear markets occur regularly and generally several times a decade – then the growth of revenues and profits from Robinhood can be triggered for a while, as well as the course of its shares.

Right now, the S&P 500 Exchanges to a high average / high benefit ratio (P / E) of 31 compared to its historical levels. Although this does not mean that an accident is imminent, it makes it more likely that besides, the performance of the stock markets will be worse in the next five years than in the previous five. Again, it could slow down the growth of robination.

Another point of data to be examined is Robinhood’s P / E ratio of 62, which is double the size of the average S&P 500. This indicates enormous expectations on the part of investors for future growth in Robinhood in the future. For this reason, I do not think it is likely that the price of Robinhood’s shares is much higher in five years than today. This makes it a stock that investors should avoid for the moment.

Charles Schwab is an advertising partner of Motley Fool Money. Brett Schafer has no position in the actions mentioned. The Motley Fool recommends Charles Schwab and recommends the following options: short December 2025 calls $ 95 on Charles Schwab. The Motley Fool has a policy of disclosure.