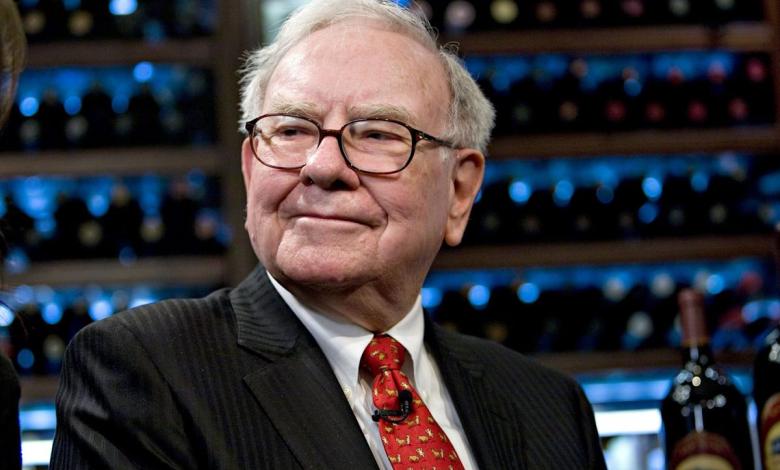

Warren Buffett has invested more than $1 billion in three stocks, and that says a lot about consumers’ current priorities: homes, beer, and gas.

-

Berkshire Hathaway Investments for 2025 Suggest Warren Buffett and his successor, Greg Abel, are focusing on consumer-centric brands, despite broader economic uncertainties. The conglomerate notably increased its stakes in homebuilder Lennar, energy giant Chevron and beverage company Constellation Brands, while reducing its exposure to financial institutions. Buffett’s decisions highlight a preference for sectors related to daily consumption and long-term goals, such as housing, energy and consumer goods.

Warren Buffett may retire as CEO of Berkshire Hathaway at the end of this year, but the conglomerate’s investment decisions still reveal a lot about the economic vision of the Oracle of Omaha.

Throughout 2025, Berkshire’s investments have focused on brands with high exposure to consumer health and insights. American buyers have held up well since the end of the pandemic, to the surprise of some economists. Brian Moynihan, CEO of Bank of America, Buffett’s long-held asset bank, said earlier this year that even as consumers were starting to worry about their cash reserves, they were nonetheless continuing to spend.

And while Wall Street and Silicon Valley rushed into AI stocks despite bubble warnings, Buffett and his successor, Greg Abel, looked further afield for investing inspiration.

Some of Berkshire’s biggest investments this year have been in brands likely to be considered essential to American shoppers or that reflect their long-term goals.

For example, Berkshire’s most recent filings reveal that it now owns some 7 million shares of Lennar, an increase of 265% from its previous holding. Lennar, one of the nation’s largest homebuilders, has seen its stock price fall 28% over the past year, but it now represents just over 3% of Berkshire’s portfolio, with its holdings between Class A and B shares now totaling more than $886 million.

However, White House action this year has focused on reviving the U.S. housing market. In his continued lobbying for a lower base interest rate, President Trump claimed that Fed Chairman Jerome Powell was “hurting the housing industry very badly.” Trump added: “People can’t get mortgages because of him. »

While Powell refrained from lowering interest rates early in the Trump administration, the Federal Open Market Committee has since begun lowering interest rates and has shown a willingness to reduce them further in the future. Although the federal funds rate does not determine the mortgage rates offered by lenders, lower borrowing costs should (as a general rule) ultimately lead to more affordable mortgages for consumers.

:max_bytes(150000):strip_icc():focal(745x363:747x365)/Isabela-Ferrer-it-ends-with-us-uk-screening-2024-justin-baldoni-new-york-premiere-081825-7d0cdac4f4b24b67a35672321ff62b1f.jpg?w=390&resize=390,220&ssl=1)