The 3 Best Billion Dollar Stocks to Buy Now. (Hint: Nvidia is not one of them.)

Changes could come in the field of artificial intelligence chips.

Nvidia (NVDA +1.51%) has been at the top of the artificial intelligence (AI) investment hierarchy since 2023. However, a significant change could be coming.

Until a few days ago, it seemed like AI hyperscalers had only a handful of options to choose from when equipping their data centers with parallel processors. Nvidia’s graphics processing units (GPUs) are by far the most popular choice, and AMDGPUs have also captured market share. Another option taken by the largest data center operators was to partner with Broadcom (AVGO 4.15%) to develop custom AI accelerators – called application-specific integrated circuits – optimized for a particular type of workload.

However, news broke recently that Alphabet (GOOG 1.07%) (GOOGL 1.18%) could sign a deal to sell a large quantity of its tensor processing units (TPUs) that it collaborated with Broadcom to design Metaplatforms. Such a deal could herald the arrival of a new competitor in the hardware market, which is why buying these three stocks now might make more sense than adding Nvidia stock.

Image source: Getty Images.

Three companies should benefit

News reports regarding the possibility of Meta purchasing TPUs from Alphabet acknowledge that it is just that: a possibility. The companies have not made firm public comments on the issue and no specific figures have been announced, although it is estimated to be in the billions of dollars. That said, there are three companies in the TPU value chain, and I think each of them is worth buying right now.

The company that will benefit the most is Alphabet.

Alphabet derives the majority of its revenue ($74 billion of its $102 billion in the third quarter) from advertising. Advertising is not a stable business: it rises and falls depending on the strength of the consumer and the willingness of companies to spend on advertising. The company also has a cloud computing business that is thriving thanks to a general shift toward cloud workloads and the bringing of new artificial intelligence workloads online.

Today’s change

(-1.18%) $-3.77

Current price

$316.41

Key Data Points

Market capitalization

3864 billion dollars

Daily scope

$314.49 -$319.74

52 week range

$140.53 -$328.83

Volume

742 KB

Average flight

38M

Gross margin

59.18%

Dividend yield

0.26%

Until now, if businesses wanted to use TPUs for their processing needs, their only option was to rent time through Google Cloud. They couldn’t buy any. If Alphabet began selling its TPUs, it would open up a new revenue stream that investors have not yet considered. That’s why Alphabet shares soared by a double-digit percentage in the days following the announcement of the possible Meta deal.

Broadcom would also be a huge beneficiary if these sales occur, as Alphabet pays the chip designer for each TPU purchased. It’s unclear whether Broadcom would make more money if Alphabet decided to sell them to third parties, but custom AI chips have become an important part of Broadcom’s business.

During the third quarter of fiscal 2025, which ended Aug. 3, $5.2 billion of Broadcom’s $15.9 billion in revenue came from AI-related sources. However, this division is growing rapidly; management expects $6.2 billion in AI revenue in the fiscal fourth quarter.

Today’s change

(-4.15%) $-16.72

Current price

$386.24

Key Data Points

Market capitalization

1903 billion dollars

Daily scope

$385.10 -$395.36

52 week range

$138.10 -$403.00

Volume

728 KB

Average flight

24M

Gross margin

63.13%

Dividend yield

0.59%

If the Alphabet and Meta deal goes through, that figure could skyrocket in 2026, improving Broadcom’s financial situation.

The final company that would benefit from this deal is one of my favorites in the AI sector: Taiwan Semiconductor (TSM 0.99%).

Semiconductor manufacturing in Taiwan

Today’s change

(-0.99%) $-2.88

Current price

$288.63

Key Data Points

Market capitalization

$1,512 billion

Daily scope

$286.48 -$290.89

52 week range

$134.25 -$311.37

Volume

313 KB

Average flight

13M

Gross margin

57.75%

Dividend yield

0.99%

Taiwan Semiconductor benefits, regardless of who ultimately wins

Nvidia has been the undisputed leader in the AI accelerator space until now, but its dominance may be waning. However, all of these AI hardware vendors are “fabless” chipmakers. They design chips, but don’t manufacture them in-house. Instead, they outsource this task to chipmaking companies, and the largest of these by far is Taiwan Semiconductor.

This positions Taiwan Semiconductor as a neutral (but vital) player in the world of AI. Its business will grow as long as spending on AI chips increases. If Nvidia’s dominance wanes and Broadcom’s custom AI units take off, TSMC will still benefit.

Despite its ability to benefit from whatever companies’ AI chips are in demand, TSMC stock trades at a much lower premium than the other stocks discussed here.

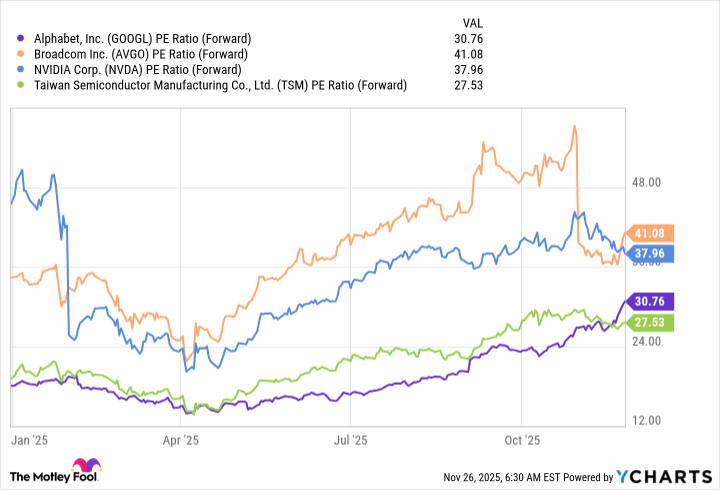

GOOGL PE Ratio (Forward) data by YCharts.

Trading at 27.5 times forward earnings, TSMC stock represents a bargain and retail investors should buy it alongside Alphabet and Broadcom, particularly if Alphabet begins selling its TPUs to other data center operators.

I still think Nvidia remains a good investment choice, but if TPUs become available for widespread purchase, these three products could become better buys.