Prediction: 1 stock of artificial intelligence (AI) to buy before its arrival 10x in the next decade

Key points

Finding actions that can increase tenfold value in a decade is a dream of each investor. These investments can be rare; For a company to increase by 1,000% in a decade, it must operate in an expanding industry.

What larger industry is there that artificial intelligence (AI) at the moment? I think it is an ideal place to search for companies likely to publish monster yields during the next decade, even if there have already been winners.

Where to invest $ 1,000 now? Our team of analysts has just revealed what they believe 10 Best Actions To buy now. Continue “

Whoever, I think, is ready to dominate in the next decade is Soundhound ai (Nasdaq: Soun). It is always a relatively small company with an evaluation of $ 6 billion. However, I could easily see him become a company of $ 60 billion in a decade in a decade if a few things happen in his favor.

Image source: Getty Images.

Soundhound AI technology is spreading

Soundhound AI merges audio recognition with AI. This allows him to perform better than traditional digital assistants, as Siri or Alexa.

Its products have in -depth applications: any commercial interaction that humans generally need with each other (such as telephone assistance or steering wheel order) can be automated by business technology.

Although the historical applications of audio recognition technology made it possible to behave relatively badly, the Soundhound AI platform can actually surpass human counterparts in many examples. We are still in the first rounds of his product deployed on a large scale, but he finds an important utility in the catering industry, automation (as digital assistants in vehicles), financial services and health care.

Soundhound AI also sets up impressive growth as its customers develops quickly. In the second quarter, income increased by 217% from one year to the next to reach $ 43 million.

This quarterly report said that seven of the 10 best global financial institutions are Soundhound customers, and four of them have renewed their contract or increased their use. It is a huge momentum and shows that wise customers get a lot of value from their product.

This increase in income will allow the company to further refine its product and create a platform which could barely be distinguished from a human counterpart. We will see how Soundhound IA is progressing in the coming years, but management is incredibly enthusiastic about its growth trajectory.

The stock is not cheap, but it is difficult to make a growing business as quickly as it is

A factor that influences the rapid growth of Soundhound AI is certain acquisitions that it has made in recent years. It is easy to develop when you buy companies, but what investors really care about organic growth.

This comes from the existing company and is what motivates a long -term higher company. The Nitesh Sharan financial director said that management sees 50% or more organic growth in the foreseeable future on an annual basis.

If Soundhound IA can offer organic growth of 50% over the next six years, this would increase tenfold income. This could provide investors with 10x yield over a decade they are looking for, but only if the stock is at a reasonable price.

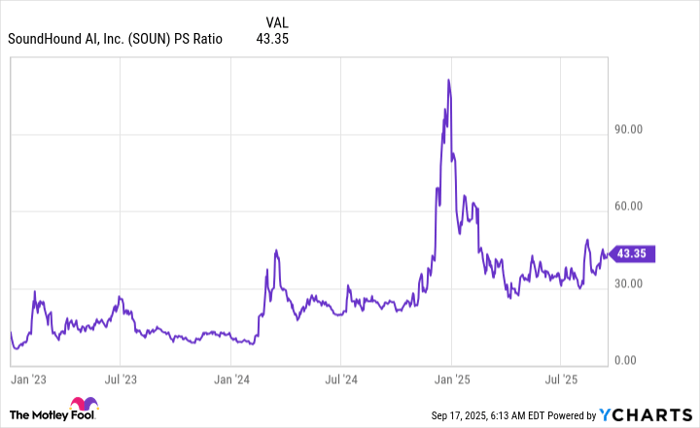

SOUN PS report data by Ycharts; PS = sales prices.

At 43 times sales, Soundhound IA is in no way cheap. But I will not blame the market for the way it assesses this stock when it triples its income from year to year and projects an annual organic growth rate of 50% in the coming years. Compared to another AI software supplier, PalantantWhich is negotiated for 125 times sales, the action seems fairly cheap.

Soundhound IA is not without risk. Nothing leads one of the other AI hyperscalers to launch a competitor product. This could considerably disrupt its business model and make growth difficult at the expected rate. In addition, the company is not deeply not profitable and it will have to return the change in profitability in the future.

However, as long as investors size their position appropriately, I think there could be an upward monster in action. Keeping a small position size can assure you that you capture the advantage while limiting the drop if the action is $ 0. Soundhound IA has the potential to be a huge AI winner, but it could also lose depending on the success of its product or if a worthy competitor occurs.

Should you invest $ 1,000 in Soundhound IA at the moment?

Before buying actions in Soundhound Ai, consider this:

THE Motley Fool Stock Advisor The team of analysts has just identified what they believe 10 Best Actions For investors to buy now … and Soundhound IA was not one of them. The 10 actions that cut could produce monster yields in the coming years.

Inquire Netflix Make this list on December 17, 2004 … if you have invested $ 1,000 at the time of our recommendation, You would have $ 661,694! * Or when Nvidia Make this list on April 15, 2005 … if you have invested $ 1,000 at the time of our recommendation, You would have $ 1,082,963! *

Now it’s worth noting Stock advisor Total average yield is 1,067% – market grinding outperformance against 189% for the S&P 500. Do not miss the last list of the best 10, available when you join Stock advisor.

See the 10 actions “

* Return shares advisor since September 15, 2025

Keithen Drury has no position in the actions mentioned. The Motley Fool has positions and recommends palantant technologies. The Motley Fool has a policy of disclosure.

The opinions and opinions expressed here are the opinions and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.