Moderate Republicans defended Biden’s climate law – then voted to repeal it

After days of intense political struggles between ultra -conservative Republicans and moderate Republicans, the House of Representatives voted Thursday morning to approve a radical tax bill which seeks to avoid the heart of the historic climate legislation adopted by Democrats only three years ago.

The 2022 climate law on blocking – the law on inflation reduction, or Ira – was the first legislation in addition to a decade to try to reduce American greenhouse gas emissions and was the centerpiece of the legislative agenda of former President Joe Biden. It provides hundreds of billions of dollars in tax credits, loans, grants and grants to public service companies, car manufacturers, consumers and others to become more economical in energy and go to carbon -free electricity sources.

Until recently, conventional wisdom in Washington was that legislators in the districts that received this money would be disintegrated to cancel the legislation that provides it, even under an ultra -conservative president like Donald Trump. “The abrogation is extremely improbable,” wrote Neil Chatterjee, a former republican commissioner of the Federal Energy Regulation Commission, in an article of opinion for the hill last August entitled “The solar investment tax credit is sheltered from the abrogation even if the Republicans win in 2024.” In March, 21 Republicans of the Chamber signed an open letter calling for any modification of tax credits will go to “be made in a targeted and pragmatic manner”.

However, the Chamber voted on 215-214 Thursday to complete the tax credits on IRA’s own energies before the scheduled date, including the solar investment tax credit that Chatterjee was sure to be sure. Only two Republicans voted against the bill, one voted present and two abstained – of which only one of the signatories of the letter of March.

Originally, the incentives were set to continue at least 2032. By virtue of the House bill, tax credits for all clean energies, with the exception of nuclear, which Republicans tend to see favorably, will only apply to projects that innovate within 60 days of the promulgation of the bill and could start sending energy to the grid. Federal tax credits to help consumers adopt clean energy technologies such as heat pumps, solar energy on the roof, storage of batteries and electric vehicles would be removed by the end of this year.

The House bill must be adopted by the Senate and signed by President Donald Trump to become law, and it is likely to change during negotiations in the upper chamber.

Megan Jellinger / AFP via Getty Images

Renewable energy developers warn that the chamber calendar to obtain projects in service is prohibitive and would effectively make some of the obsolete tax credits. “If the congress does not change course, this legislation will upset an economic boom in this country which has delivered a historic rebirth of American manufacture,” said Abigail Ross Hopper, president and chief executive officer of the Solar Energy Industries Association, in a press release.

Abrogations would have an impact on the main projects on the scale of public services which are already underway, such as Wind Projects, said Katrina McLaughlin, partner in the American energy team of the World Resources Institute, because it takes a lot of time to obtain most renewable projects.

“Placed in service means that everything must go to the right. We have delays in interconnection queues, we have allowed delays, there can be challenges to obtain different materials and resources,” said McLaughlin. “So getting into service by 2028 is in fact a fairly aggressive chronology.”

In the two years which followed the adoption of IRA, the analyzes show that federal funding has catalyzed more than $ 400 billion in manufacturing, electric vehicles, hydrogen power, renewable energies and other green initiatives and stimulated more than 400,000 new jobs. The analyzes show that the vast majority of tax credits on IRA’s own energies and subsidies – 78% – went to red districts in rural and suburban areas.

AS House Speaker Mike Johnson Sought to Unite His Party Behind Trump’s Domestic Agenda, Two Warring Factions Emerged: A Far-Right Coalition Focused On Attaining Deeper Spending Cuts by Slashing the Ira and Medicare, and A moderate Group Agitating To Retain Clean Energy Energy Districts and Increase the Cap On How Much State and Local Tax can be Deducted from One’s Federal Taxes – A Change That Would Benefit High Earners in Blue States.

Unsurprisingly, the legislator leading to the fight against IRA comes from an area that has not received a lot of money. Representative Chip Roy, leading the ultra -conservative crusade, represents a district in Texas which has just under one dollar per person in the investments announced by IRA. Meanwhile, one of his colleagues on the other side of the fight, the moderate republican representative Nancy Kiggan, comes from a district of Virginia which should receive $ 85.50 of investments per capita.

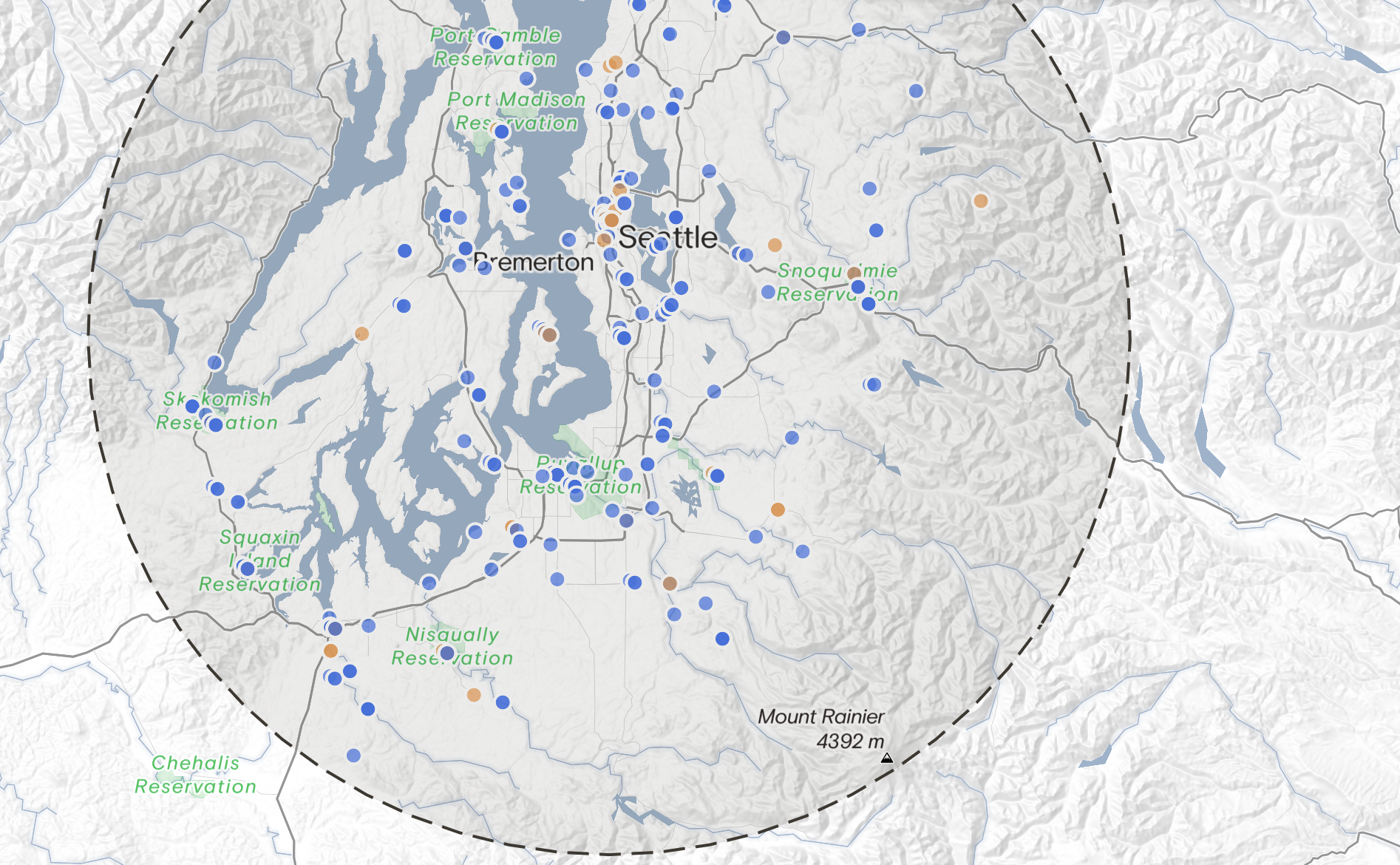

Where did billions of climate and infrastructure go? Look for our card by postal code.

Republicans represent 18 of the 20 main congress districts benefiting the most investment in clean energy since the adoption of IRA, according to the ATLA Public Policy research company. The first three districts on this list, in North Carolina, in Georgia and Nevada, had received almost $ 30 billion in the legislation in March of this year. But in the end, all republican legislators representing these 18 districts voted in favor of the effectively end of investments. Democrats, whose caucus decreased due to the death of three members this year, were united in opposition.

In the end, the moderate republican caucus was willing to exchange tax credits will go for other political priorities. Moderate in high tax states like New York were ready to use Biden tax credits as a negotiating currency for a higher limit to detailed state and local tax deductions – $ 40,000, against the current ceiling of $ 10,000 – a political victory, with advantages that these legislators could harm immediately, which allowed them to bypass the possibility of defending the legislation adopted by democratic administration.

Republicans could also set up the fact that many of their voters do not know IRA. Last year, an investigation by the University of Chicago and the Associated Press revealed that two years after the IRA passage, most Americans had a supremely wrong understanding of what the legislation is and done, if they knew it at all. Only 21% of adults interviewed, for example, tax credits for people to buy electric vehicles were useful. Almost 40% did not know enough to weigh on EV tax credits and a shocking 15% of those questioned thought that politics – which gives consumers up to $ 7,500 for a new EV plug -in – injured people like them.

According to Josh Freed, Vice -President Director of Climate and Energy in the Reflection Group, part of the problem is that IRA’s own incentives – such as new union jobs and the main infrastructure projects – take years to come forward. “Not enough clean energy financing released fairly quickly,” he said. “It’s a big impact, don’t get me wrong, but it is not yet part of the communities fabric in a way that would flit people if it disappeared.”