Is Verizon Stock still a good deal after the latest 5G extension news?

If you are wondering what to do about Verizon Communications actions at the moment, you are certainly not alone. The closing of the share price at $ 43.67 and a gain of 8.6% for the start of the year, Verizon drew the attention of investors who are looking for a solid telecommunications game with solid fundamentals. In the past year, the stock increased by 5.5%, with a roller coaster tour between the two. The past few weeks have been a little more silent, only staining 0.1% in the last seven days, but sliding 1.6% in the last month.

Recent market developments in telecommunications space, such as increased attention to 5G infrastructure and current debates on consumer demand, seem to move risk perceptions in companies like Verizon. Long -term holders have experienced a slight negative return in the past five years, but if you look at the situation as a whole, the figures suggest that things could change for the best, at least short and in the medium term.

And the value? According to most objective measures, Verizon seems relatively inexpensive at the moment. He passes 5 checks of keys to 6 keys, which earns him a value score of 5. It is a difficult signal to ignore, especially if you detect stocks that could fly under the radar.

So, how do we know if the recent gains from Verizon are justified, or if the stock is really as undervalued as it seems? Let’s make the most common evaluation methods and see where Verizon is. A little later, I will share a more intelligent perspective that could well change the way you completely think of the evaluation of actions.

Why Verizon Communications is lagging behind its peers

Approach 1: Analysis of Reduced Cash flows by Verizon Communications (DCF)

The model of cash flow at reduced prices (DCF) estimates the value of a company by projecting its future cash flows, then removing those which return to the value of today. This approach provides a current estimate of what the company should be worth according to its ability to generate money over time.

For Verizon Communications, the DCF model begins with the cash flows available from last year, totaling $ 15.3 billion. Analysts are planning to grow cash flow available for the next five years, with a 2029 projection of 23.9 billion dollars. Beyond these years, the simple Wall St extrapolates an increase, with nearly $ 29.0 billion projected by 2035. All projections are in dollars, reflecting strong gains after a stable cash production period.

Based on this model, the estimated intrinsic value of Verizon per share is $ 134.86, while the current share of the share is $ 43.67. This results in a calculated discount of 67.6%, which suggests that the action is negotiated considerably lower than its intended intrinsic value.

Result: undervalued

Head to the evaluation section of our works report for more details on how we arrive at this fair value for Verizon Communications.

Our reduced cash flow analysis (DCF) suggests that Verizon Communications is undervalued 67.6%. Follow it in your surveillance list or your wallet, or discover more undervalued actions.

Approach 2: Verizon Communications Prix VS Gaining (PE)

When evaluating a profitable company like Verizon Communications, the price / benefit ratio (PE) remains one of the most reliable assessment tools. Indeed, it directly connects the course of the action of a company to its profits by share, which makes it particularly useful when the company generates coherent profits.

It is important to remember that a “normal” or “fair” PE ratio for any business depends on several factors. Higher growth expectations may justify a higher PE, while increased risk or slower growth will generally lead to a lower PE considered reasonable. The context of industry and the stability of profits also play crucial roles.

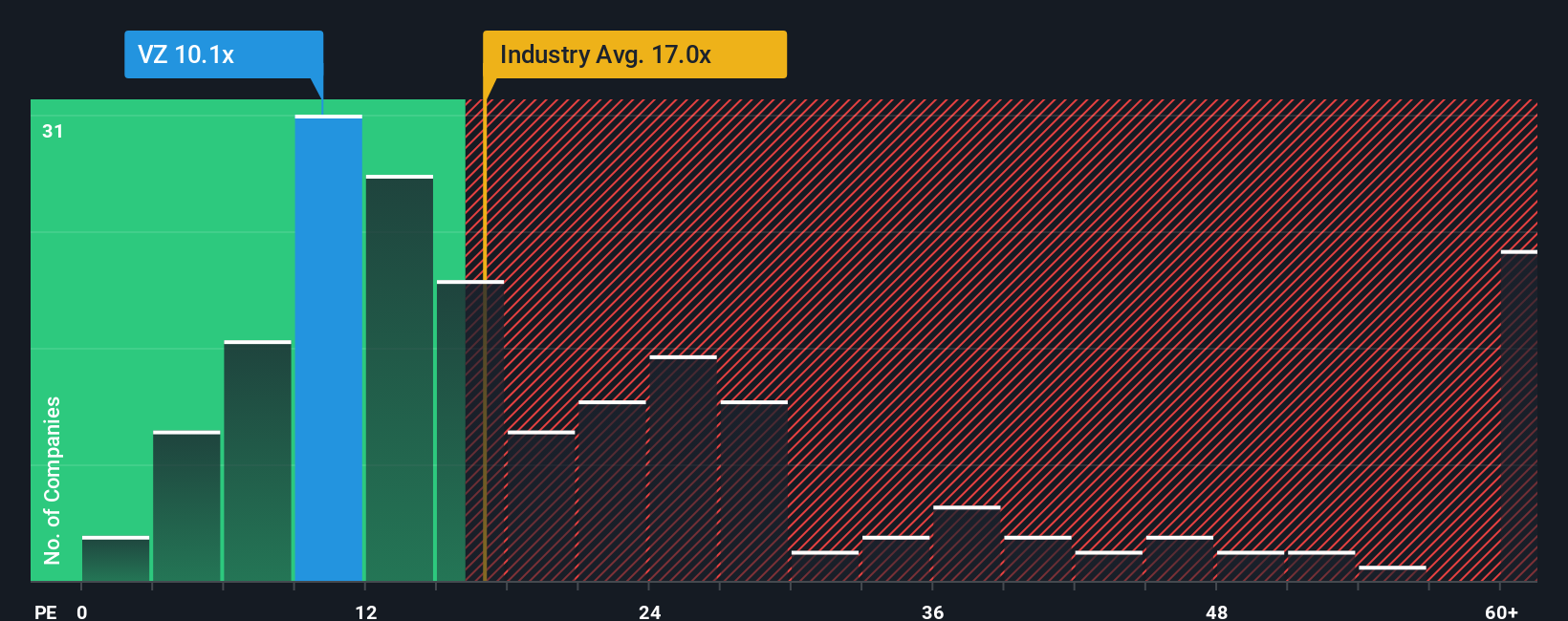

Verizon’s current PE report is 10.1x. To put this in perspective, the average EP for the telecommunications industry is 17.0x, and among its nearest peers, the average is 24.4x. This makes Verizon cheap at first glance compared to its industry and peers. However, these large comparisons often ignore the crucial factors that shape the real value of a business.

This is where the equitable ratio of Wall St by Wall is. In this case, the fair report for Verizon is 15.7x. Since this method explains more than approximate averages, it provides a more intelligent and more holistic reference for value.

By comparing the fair ratio with real PE, Verizon is negotiated with a significant discount to what would be expected given its prospects and risks. This indicates that the stock is undervalued according to multiple profits.

Result: undervalued

The PE ratios tell a story, but what happens if the real opportunity is elsewhere? Discover the companies where initiates are betting very well on explosive growth.

Improve your decision -making: choose your Verizon Communications story

Earlier, we mentioned that there is a better way to understand the evaluation, so let’s present the stories. A story is a simple and dynamic tool that allows you to define your story or your perspectives for a company like Verizon Communications by linking your assumptions about its future income, income and margins directly to a financial forecast and a fair value estimate.

Unlike static assessments, the stories allow you to connect the “why” behind your estimates with real numbers. You can instantly see how changes in commercial, industrial or news events from Verizon affect what you think is worth. Available directly on the Platform Community page simply Wall ST, the stories are easy to use and trust by millions of investors worldwide.

With the stories, you can easily compare your fair value during the current action of Verizon’s current action, helping you decide when it could be time to buy, hold or sell. The stories are updated automatically as the news or data on the profits are coming, by maintaining your informed and up -to -date investment decisions.

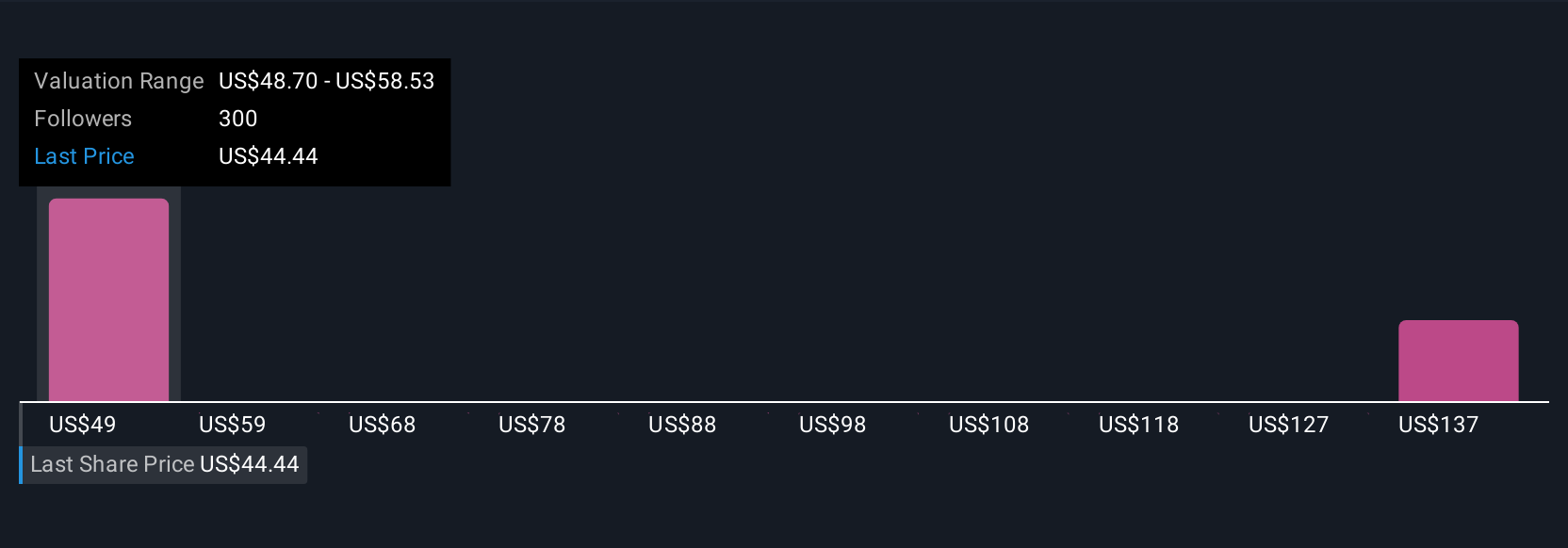

For example, some investors think that the fair value of Verizon is as low as $ 42, while others see it up to $ 58. It all depends on their hypotheses and their perspectives, making accounts an essential tool for intelligent and adaptive investment.

Do you think there is more in history for Verizon Communications? Create your own story to inform the community!

This article by simply Wall St is general. We provide comments based on historical data and analysts forecasts only using an impartial methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to purchase or sell stock and do not take into account your objectives or your financial situation. We aim to provide you with a long -term targeted analysis drawn by fundamental data. Note that our analysis may not take into account the latest ads of the company sensitive to prices or qualitative equipment. Simply Wall St has no position in the actions mentioned.

New: Manage all your stock wallets in one place

We created the Ultimate wallet companion For equity investors, And it’s free.

• Connect an unlimited number of wallets and see your total in a currency

• Be alerted to new warning or risks by e-mail or mobile

• Follow the fair value of your actions

Try a demonstration wallet for free

Do you have comments on this article? Concerned about content? Contact us directly. Alternatively, send an email to leéditorial-am@simplywallst.com