Is this the only stock that will outperform Nvidia in the next 3 years?

Competition could reduce Nvidia’s revenue in the coming years.

Nvidia (NVDA 0.20%) The stock has been doing like gangbusters in recent years. The company’s dominance in manufacturing graphics processing units (GPUs) to power data centers and run high-level artificial intelligence (AI) programs has helped Nvidia become the world’s largest company by market capitalization.

Nvidia stock is up 1,390% in the last three years alone. Investing $10,000 in October 2022 would have given you a balance of $148,800 today.

I expect Nvidia to continue to perform well, but it will face pressure. Competitor Advanced microdevices is also striving to gain market share in the GPU market. It has just signed an agreement with OpenAI to provide several generations of GPUs. Alphabet, Amazon, Microsoft, MetaplatformsAnd Tesla all work on their own in-house chips. And Chinese companies are working on their own chips.

Image source: Getty Images.

So even though Nvidia has over 90% market share in the GPU market today, that might not be the case for long. But I see another company that I think has a great chance of surpassing Nvidia in the next three years. And it’s not a competitor to Nvidia. He’s a partner.

The company that could surpass Nvidia

Semiconductor manufacturing in Taiwan (TSM 0.90%) occupies a similar position to that of Nvidia: it is the main manufacturer of semiconductor chips. Essentially, Nvidia and its competitors design GPUs and other products, and TSMC builds them. Nvidia CEO Jensen Huang calls TSMC’s manufacturing process “magical.”

TSMC has manufactured more than 11,800 different products in 2024, using 288 distinct processes. Sixty percent of the company’s revenue comes from manufacturing 3 nanometer (nm) and 5 nm chips, which are essential for semiconductor manufacturing. Semiconductor makers, like Nvidia and AMD, are valuing smaller and smaller circuits because the more stuff a company can put on a chip, the more powerful it is. TSMC is one of the few manufacturers manufacturing 3nm chips on a large scale and plans to mass produce 2nm chips this year.

Statista reports that TSMC has about 70% of the semiconductor manufacturing market today. And the best? This is unlikely to change substantially. TSMC makes Nvidia chips, but also makes chips for AMD, Amazon, Apple, Alphabet and Qualcommamong others.

So whichever company grabs Nvidia’s dominant market share will likely come to TSMC to make the chips.

Semiconductor manufacturing in Taiwan

Today’s change

(-0.90%) $-2.72

Current price

$300.50

Key Data Points

Market capitalization

$1,558 billion

Daily scope

$296.68 -$307.63

52 week range

$134.25 -$311.37

Volume

560K

Average flight

12M

Gross margin

58.06%

Dividend yield

0.01%

Business issues and other obstacles

There has been a lot of talk this year about trade barriers, tariffs and other adverse factors that could hurt the semiconductor market. President Donald Trump, like his predecessor, has been keen to encourage the development and manufacturing of semiconductors in the United States. If you recall, it was under the Biden administration that Congress passed the CHIPS Act to spur development on American soil.

That’s why it’s important that TSMC diversifies its manufacturing sites, investing $165 billion in increasing its capacity in Arizona, where it currently makes Nvidia Blackwell chips. TSMC is building six manufacturing plants in the north Phoenix area.

U.S. chip manufacturing will be important as U.S. companies look for ways to avoid tariffs — and White House difficulties — by manufacturing chips on U.S. soil. CEO CC Wei said in October that the company would continue to invest in Taiwan, but would accelerate its production expansion and technology upgrades on U.S. soil.

TSMC’s dynamic growth bodes well for the next three years.

Another reason I like TSMC stock: Taiwan Semiconductor’s revenue is already up sharply, holding steady at 36% year-over-year growth.

|

Month |

Net income |

Change from year to year |

|---|---|---|

|

January 2025 |

$9.59 billion |

39.5% |

|

February 2025 |

$8.50 billion |

43.1% |

|

March 2025 |

$9.35 billion |

46.5% |

|

April 2025 |

$11.43 billion |

48.1% |

|

May 2025 |

$10.48 billion |

39.6% |

|

June 2025 |

$8.63 billion |

26.9% |

|

July 2025 |

$10.57 billion |

25.8% |

|

August 2025 |

$10.98 billion |

33.8% |

|

September 2025 |

$10.10 billion |

31.4% |

|

Total |

$90.42 billion |

36.4% |

Source: TSMC. Income converted from new Taiwan dollars.

The company regularly hits $10 billion in revenue per month and issued fourth-quarter guidance calling for revenue of $32.2 billion to $33.4 billion, with an operating margin of around 50%.

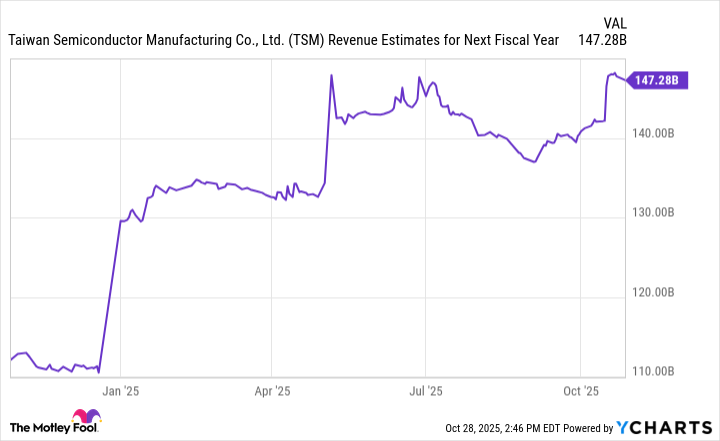

These are dynamic numbers – and I have no doubt they will continue. The same is true for Wall Street, as TSMC’s revenue estimates have steadily increased throughout the year. Next year’s revenue is expected to exceed $147 billion.

TSM revenue estimates for next fiscal year data by YCharts.

If you’re looking for a company that can beat Nvidia in the next three years, look at the company that makes its chips, as well as those of its competitors. It’s TSMC.