Is it a purchase now? – TradingView News

Hims & Hers Health, Inc.HIMS investors have experienced short -term gains in the action recently despite its bumpy route in recent months. The actions of the health and well-being platform based in San Francisco, California, won 85.1% compared to the 16.8% increase in industry in the same period of time. He also outperformed the sector and the 9% drop in S&P 500 and an increase of 5.6%, respectively.

A major Hims development this month has included its agreement to acquire Zava, a digital health platform in Europe. Two other notable developments in recent months include its announcement that eligible customers can now access six months of Wegovy on a prescription only at an affordable new price of $ 549 per month (in May) and long -term collaboration with Novo Nordisk (in April).

However, wholesale of wholesale HIMS in the first quarter of 2025 were disappointing. The gross margin has contracted due to the increase in products of the products, which do not increase well for the stock.

HIMS Three months of price comparison

In the past three months, the performance of the action has remained solid, surpassing its peers as Teladoc Health, Inc. TDOC and American Well Corporation AMWL, popularly known as Amwell. Teladoc Health and Amwell’s shares plunged 13.7% and 13.3% respectively, in the same time.

Despite several challenges on the health and well-being market, including complications related to labor and epidemics or health pandemics, estimates indicate that the company could be able to maintain the positive time of the market.

HIMS provides revenues for the second quarter of 2025 and all year round in bands of $ 530 million to $ 550 million (reflecting an increase from 68 to 74% from one year to the next) and from $ 2.3 billion to 2.4 billion dollars (representing growth of 56 to 63% from 2024), respectively. The estimate of the Zacks consensus for income for the second quarter and the full year is currently set at $ 551.8 million and $ 2.34 billion, respectively, while the same profit per share is currently set at 17 cents and 73 cents.

Hims & Hers has a unique mixture of a clinically focused electronic medical record system, digital prescriptions and the realization of the cloud pharmacy, each with multiple growth engines promising robust growth potential.

The solid fundamentals of Hims help him

HIMS aims to provide a group offer from Wegovy approved by the FDA of Novo Nordisk on the Hims & Hers platform as the first stage of the collaboration roadmap, combining innovative treatments with a leading care platform to raise the impact of obesity care for consumers. The announcement of the company according to which eligible customers will now have access to six months of Wegovy on prescription at $ 549 per month, in force on May 22, 2025, also highlights its objective of making the care and proven treatments and the treatments more accessible, affordable and connected for the Americans.

In May, Hims & Hers announced the price of its convertible senior notes offer of $ 870 million and the appointment of Mo Elshenawy as a new director of company technology. HIMS intends to use the proceeds of the convertible elderly tickets offering to support its global expansion thanks to organic growth and strategic acquisitions, while fueling more in -depth investments in artificial intelligence (AI), diagnostics and personalized treatments to change access and meet the growing demand for high quality personalized care. The appointment of the new technology director should help him accelerate his vision of building the new generation health platform powered by AI which is designed to provide deeply personalized and accessible accessible care.

HIMS & HIS ‘focus on international expansion

This month, Hims announced its agreement to acquire Zava, marking an important step towards its global expansion. The agreement will probably expand the company’s imprint in the United Kingdom and officially launch the company in Germany, France and Ireland, with more markets planned soon.

Hims & Hers also plans to introduce a new personalized dimension of digital health in Europe. Thanks to this, the company aims to provide individuals with access to care adapted to their specific needs and objectives through dermatology, weight loss, sexual health and mental health. To ensure localized experience, this expansion should also include access to British, German and French health care providers in local languages. Hims and his family expect to share more on offers and their deployment in the coming months.

Hims & Hers extended to the United Kingdom at the beginning of 2021 and, in June 2021, he completed the acquisition of Honest Health Limited, based in the United Kingdom, which is now Hims & Hers UK Limited (“HHL”). The acquisition of HHL allowed Huim and his to further expand operations in the United Kingdom.

TO COMMENT TIMES FOR HIMS

In the first quarter of 2025, the gross margin of Hims & Hers contracted 886 base points due to an increase in the cost of income. This poses a challenge for the company if it is unable to control its costs in the future.

Evaluation of Hims & Hers actions

The 12 -month -old Hims striker of 5.3x is less than the 6x average of the industry, but is higher than his median of five years of 2.6x.

Teladoc Health and Amwell’s Forward 12 months P / s is currently at 0.5x and 0.4x, respectively, in the same time.

Hims estimate movement

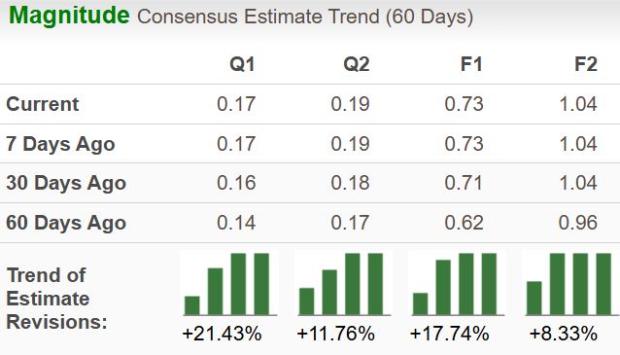

Hims & Hers’ profits estimates in 2025 spent 17.7% north to 73 cents in the last 60 days.

Our latest version of Hims and his own

It is undeniable that Hims & Hers is in terms of favorably in terms of basic force, prowess of profits, solid financial bases and global opportunities. The strong growth prospects of the company Zacks Rank # 2 (buy) make it a solid investment choice at the moment. You can see The complete list of today’s Zacks # 1 (Strong purchase) is here.

For those who explore to make new additions to their portfolios, the evaluation indicates higher performance expectations compared to its peers in industry. It is always valued lower than industry, which suggests a potential place for growth if it can line up more closely with the overall market performance. The ZACKS style score favorable with a growth score of a continuous upward trend potential for HIMS.

This article initially published on Zacks Investment Research (Zacks.com).

Zacks investment search