Buy this technology stock (ADBE) down 40% for the increase in AI – June 10, 2025

Main to remember

- Adobe is negotiated 40% below its summits before its T2 Fy25 version Thursday.

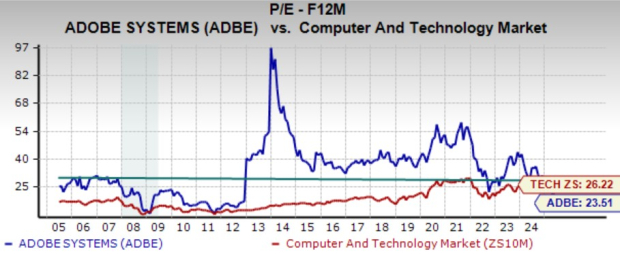

- Adbe held his field at a key level and is negotiated at a discount on technology in terms of evaluation.

- Adobe fights against artificial intelligence with his own creative IA software.

Adobe ((Adbe – Free report) )) The shares are negotiated at 40% below its peaks of all time after its release from the benefit of the T2 for FY25 on Thursday.

The power of creative software, which has doubled the technological sector in the past 15 years, has sang while Wall Street is concerned about slowing growth and levels of evaluation.

More importantly, investors should know if Adobe can push the rapid acceleration of artificial intelligence offers that allow users to generate high -end creative content of images to videos by clicking on a button and almost no skills.

Adobe does not go down without fighting, deploying the features of the AI throughout his wallet. In addition to that, the creative software giant has continued to improve its content creation service powered by artificial intelligence, Adobe Firefly, since its launch over two years ago.

The ACTE ADBE is holding a terrain for a key technical fork and is negotiated at a discount on technology in terms of long -term benefits.

The time may have come for investors to consider buying Adobe beaten on the decline for the long-term increase.

Why is the stock of Adobe down 40%

Adobe’s income growth has recently slowed down, with an average of 11% of sales between financial year 22 and 24. This came after the owner of Photoshop increased its sales by 15% to 25% for seven consecutive years after the transition to a subscription model.

The slower income growth has forced Wall Street to recalibrate its evaluation, especially in a higher interest rate environment. Adobe’s profits have also changed aside in recent years, although its real income has increased considerably.

Image source: Zacks Investment Research

Wall Street was also disappointed that Adobe had to delete its planned FIGMA acquisition on regulatory opposite winds at the end of 2023. Adobe is still waiting for another opportunity to deploy your money and diversify.

Most investors fear that Adobe’s creative software suite will become essentially obsolete due to AI.

Several AI generating companies allow people to create complex and high quality images, videos and beyond at Lightning speed without any training, design skills or technical expertise.

Adobe can succeed in a creative environment focused on AI

Adobe’s creative software has been used by all, Hollywood cinema studios and the best -selling artists for students and offices for years. Adbe’s offers include Photoshop, Premiere Pro, Illustrator and Lightroom.

In addition to its basic software focused on design, Adobe has expanded its segments linked to more traditional companies beyond PDF and electronic signatures.

Image source: Zacks Investment Research

Wall Street is concerned that even Hollywood studios and other giants will increasingly use AI. Meanwhile, marketing companies, advertisers and beyond are even more likely to turn to artificial intelligence for their creative content creation needs.

Adobe has crucially devoted the characteristics of artificial intelligence in Photoshop and beyond to fight against the challengers focused on AI. More importantly, he unveiled his creative platform for generating AI, Firefly, in 2023. He has gone everything on his AI Firefly platform since then.

The company boasted in a press release of April 24 according to which “Adobe Firefly has revolutionized creative industry and generated more than 22 billion assets worldwide” since its inception.

The company unveiled the latest version of Firefly at the end of April, which “unifies the tools fueled by AI for the generation of image, video, audio and vector in a single coherent platform and introduces many new capacities.”

Image source: Zacks Investment Research

“Firefly has become the solution of ultimate creative AI, designed to be commercially sheltered from the most important brands.

Adobe’s AI AI features are designed to be commercially viable, while other services could encounter a ton of copyright violation problems and other legal battles.

In addition to that, Firefly for Mobile “will be able to generate incredible images and videos on the go, directly from your iOS or Android device”.

Adobe is expected to increase its 9% income in fiscal year 25 and 10% in fiscal year 26 to $ 25.63 billion. The adjusted profits of ADBE should jump by 11% and 13%, respectively.

Image source: Zacks Investment Research

The company beat our net estimates for five years of racing. His profits estimates have maintained since his release from the first quarter of the financial year in early March after reaffirming his financial objectives for the 201025 financial year, stimulated by his ability to “capitalize on the acceleration of the creative economy motivated by AI”.

It’s time to buy Adobe actions on Dip and Hold?

Adobe Stock has climbed almost 1,500% over the past 15 years to double the technological sector. This huge outperformance includes a 2% rise in the past five years against 110% tech. Adbe is negotiated where he was five years ago after held the ground near his early selling heights.

The technological action is back above its very long-term mobile average of 21 weeks while negotiating at almost neutral RSI levels.

ADBE is negotiated at 40% below its summits and 20% below its objective of average ZACKS. In addition, on the speculative side, Adobe (currently negotiating at $ 416 per share) could announce a split of shares at some point to make it more attractive for investors and retail merchants.

Image source: Zacks Investment Research

The Seloff, mixed with its growth prospects for solid profits, made a 75% discount compared to its heights of all time and 33% lower than its median at 23.5 x returned from 12 months.

Adobe is even negotiated with a 10% discount compared to the technological sector despite its long -term outperformance.