Hbar Price faces a crucial test at $ 0.22 Support: What is the next step?

While the recent decline in bitcoin continues to weigh on the wider Altcoin market, the native token of Hedera Hbar has dropped almost 20% in the last seven days.

On the daily graphic, the token hangs dangerously close to breaking a level of key support, which raises concerns of a deeper correction. However, not all signals are fucked. Channel data flashes two encouraging signs that could refer to potential reversal.

The rupture of Hedera’s Hbar faces

The readings of the HBAR / USD day graphic show trading Altcoin near its 20 -day exponential mobile average (EMA). With the pressure of the escalation sale, a violation below this key support floor formed at $ 0.22 probably seems in the next trading sessions.

For TA tokens and market updates: Do you want more symbolic information like this? Register for the publisher Daily Crypto newsletter Harsh Notariya here.

The 20 -day EMA measures the average price of an asset in the last 20 days of negotiation, which gives weight to recent prices. This is a widely used technical indicator that smooths the recent price action to help identify trends.

When the price of an asset is about to break below this level of support, its short -term momentum is weakening.

If the price falls below this line, especially after a prolonged upward trend, it signals a potential passage of bullish feeling. This configuration often triggers additional sales as traders interpret it as a loss of short -term support.

Hbar slides, but the bulls hold the line

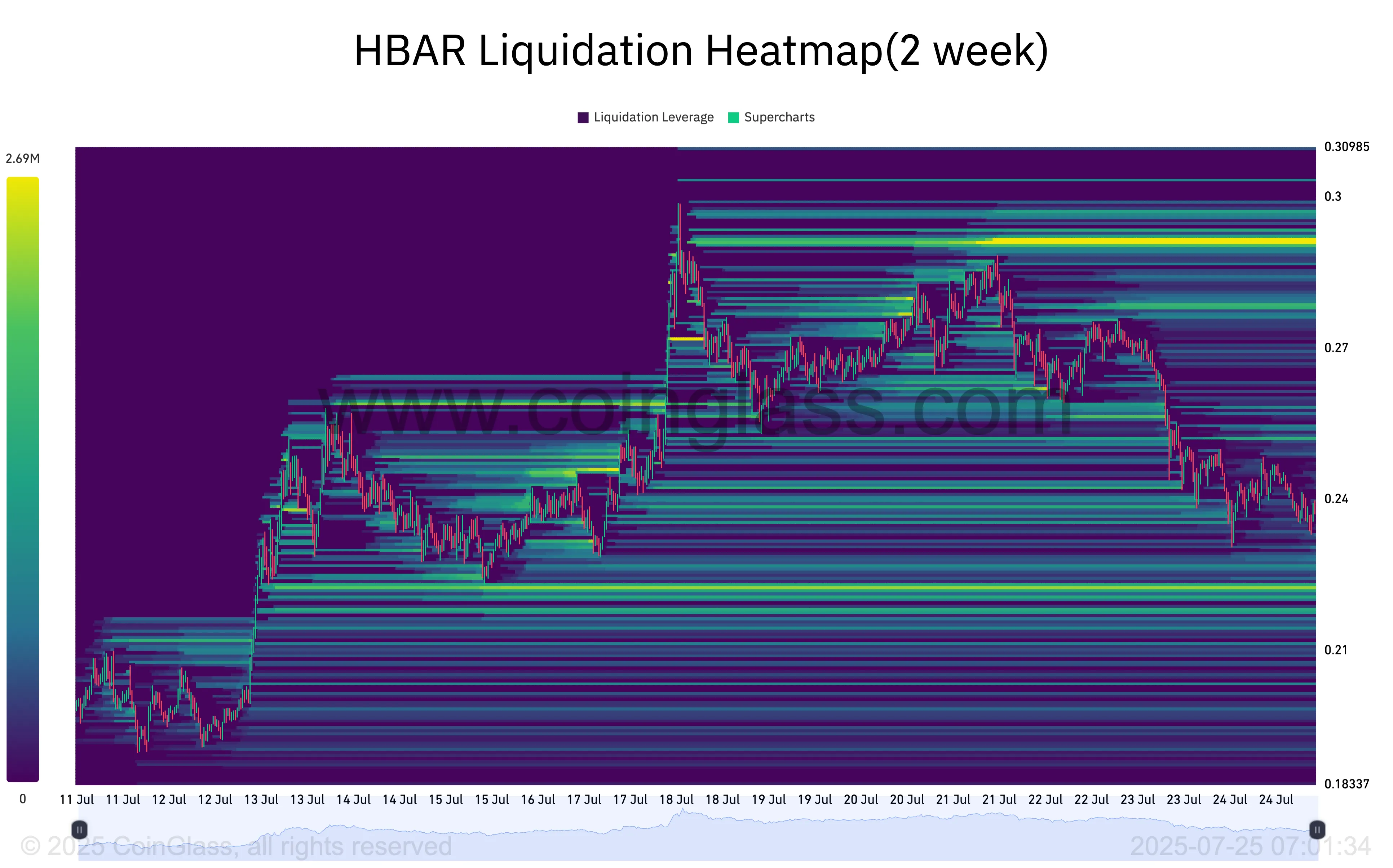

However, not all signals are fucked. Some chain data suggests that a potential reversal may be in progress. First, the Hbar thermal liquidation thermal card shows a significant liquidity cluster around $ 0.29, according to Corglass data.

Thermal liquidation marks identify the price zones where the clusters of leverage are likely to be liquidated. These cards highlight the high liquidity areas, often coded by color to show the intensity, with brighter (yellow) areas representing greater liquidation potential.

When capital clusters are formed above the current market price of an asset, they often attract the upward price movement. The merchants target these areas to trigger stop-loss or liquidations, creating a short-term bullish pressure.

For Hbar, this cluster of liquidity around $ 0.29 could act as a price magnet, which attracted the asset above as the market moves to operate this command pool.

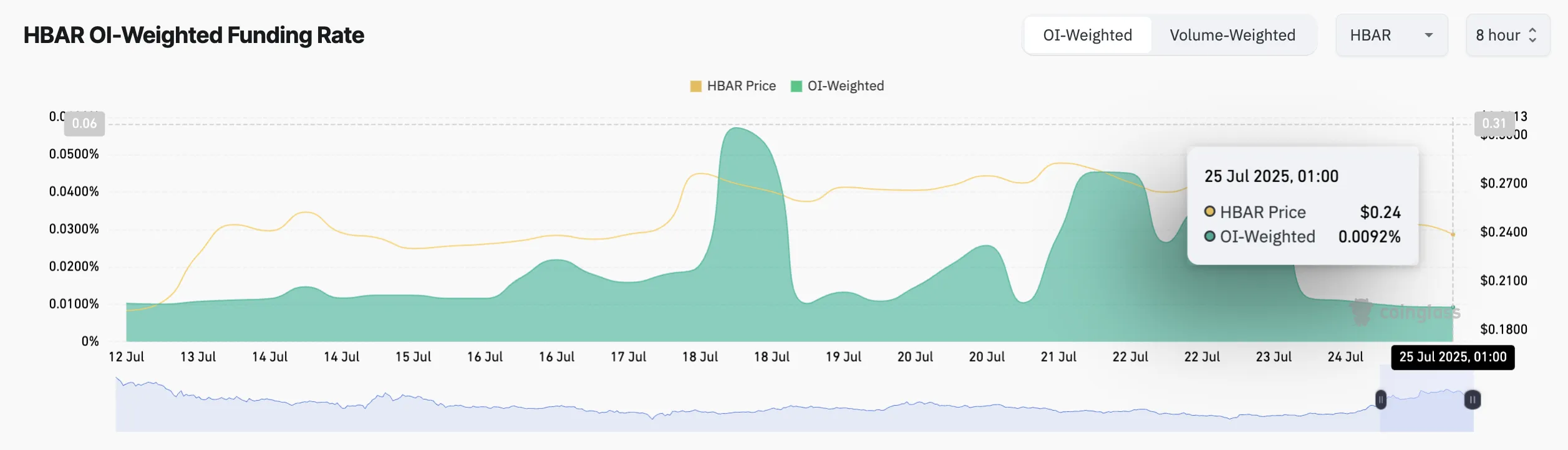

In addition, Hbar’s financing rate has remained positive despite the dull performance of its price in recent days. When writing these lines, this is 0.0092%, indicating the preference for long positions among players on the term market.

The funding rate is a periodic fee paid between long and short traders in perpetual term markets to maintain the contract price in accordance with the cash price. When it is positive, more traders bet on the price of the assets to increase, and longs pay shorts to maintain their positions.

Hbar’s always positive financing rate, even during its recent decline, reports a persistent bullish feeling among traders. He suggests a potential rise once the market conditions stabilize.

Hbar’s fate is hung on EMA from 20 days to $ 0.22

Improvements of the broader feeling of the market could strengthen the dynamic support formed by the EMA of 20 days of Hbar at $ 0.22. If this level has remained, it can act as a launch for a short -term rebound towards the $ 0.26 bar.

However, a decisive rupture below this support area could expose HBAR more downwards, potentially resulting in the price as low as $ 0.18.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. BEINCRYPTO is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.