2025 California Health Benefits Survey

This survey asks employers about the cost of individual coverage and coverage for a family of four for up to two of their largest plans.

Health insurance premiums

In 2025, average premiums for covered workers in California are $10,033 for individual coverage and $28,397 for family coverage. Premiums for covered workers in California are higher than for covered workers nationally, both for individual coverage ($10,033 versus $9,325) and family coverage ($28,397 versus $26,993).

Type of package: Premiums vary depending on plan type. The average annual family premium for workers covered in HMOs is lower than the overall average ($26,562 versus $28,397). Average premiums for workers covered in HDHP/SOs, including HSA-qualified plans, are similar to the overall average for individual and family coverage.

Company size: The average annual premium for family coverage is lower for covered workers at companies with 10 to 199 workers than for covered workers at large companies ($24,990 versus $29,595).

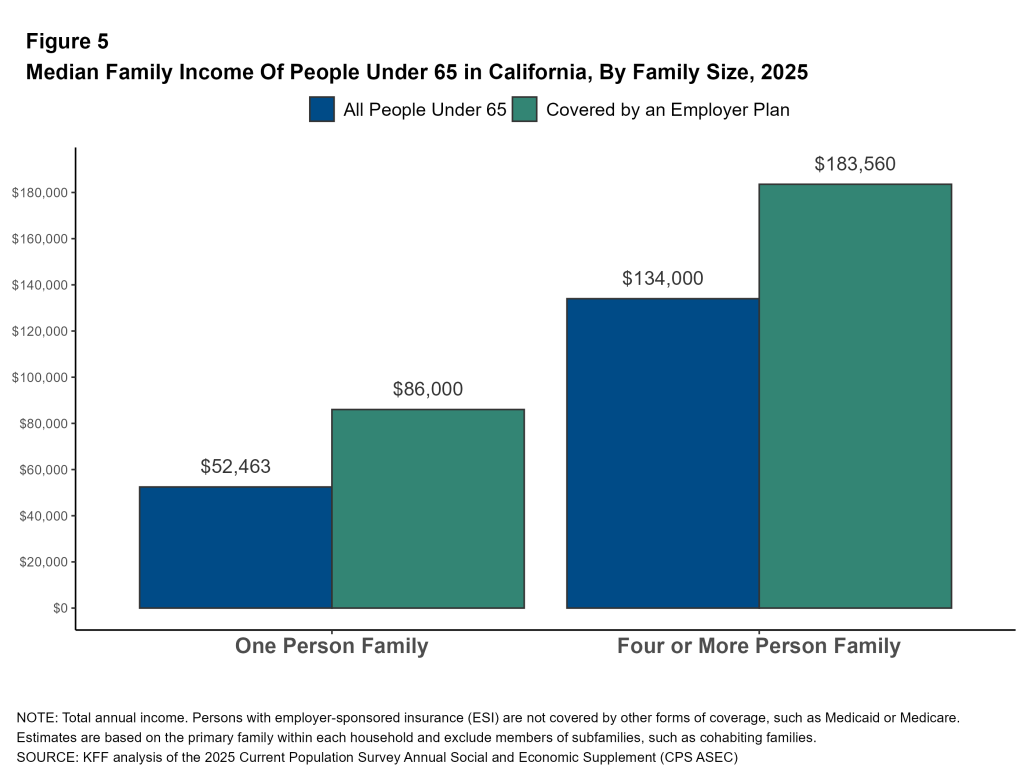

These premium amounts can be compared to the income of people with employment-based coverage. In California, non-elderly people with employer-sponsored insurance and living alone have a median income of $86,000. Among families of four with employer-sponsored insurance, the median income is $183,560. Among all families of four, including those not enrolled in an employer plan, the median family income is $134,000.

Company Features: Bonuses vary depending on the age of the company’s workforce.

- In California, average premiums for covered workers at companies with a high proportion of young workers (companies where at least 35% of workers are 26 or younger) are lower than average premiums for covered workers at companies with a lower proportion of young workers for family coverage ($24,906 versus $28,614).

- In California, average premiums for covered workers at companies with a high proportion of older workers (companies where at least 35 percent of workers are age 50 or older) are higher than average premiums for covered workers at companies with a lower proportion of older workers, for both individual coverage ($10,543 versus $9,413) and family coverage ($30,099 versus $26,289).

Premium growth: Since 2022, family premiums have increased 7% annually in California, which is similar to the overall national increase of 6%. Premiums for individual coverage have increased 8% annually in California and 6% nationally. For comparison, the annual inflation rate over the period was 4% on average and workers’ wages increased by 5%. Last year, workers’ wages increased by 4% and inflation was 2.7%.

Since 2022, the average premium for family coverage has increased from $22,891 to $28,397, an increase of 24%, compared to inflation (12.2%) and wage growth (14.4%). In the years preceding the implementation of CHBS 2022, the economy had experienced high general inflation. Since 2020, inflation has increased by 24%, much faster than the 10% increase between 2015 and 2020, or the 8% increase between 2010 and 2015.

Distribution of bonuses: Premiums for family coverage in California vary widely. Premiums are set based on a variety of factors, including the cost of in-network providers, the scope of covered benefits, the cost-sharing structure, and the number of health services used by enrollees. Among California workers with single coverage, 15% are employed at a company with an average annual premium of at least $12,500. Fifteen percent of covered workers participate in a plan with a family premium of less than $21,000, while 27% participate in a plan with a family premium of $33,000 or more.

Workers’ contributions to the premium

For many workers, health insurance is an important part of their total compensation. At the same time, most workers are required to contribute directly to the cost of their health insurance premiums, usually through payroll deductions. The average contribution for covered workers in California in 2025 is $1,303 for individual coverage and $7,312 for family coverage. On average, covered workers in California contribute an amount similar to the national average to enroll in individual or family coverage.

Employers contribute more to the cost of single coverage for covered workers in California than employers nationally ($8,730 versus $7,884).

Change over time: Compared to 2022, California-covered workers contribute a similar amount to enroll in individual coverage ($1,192 vs. $1,303) and family coverage ($6,735 vs. $7,312). Since 2022, the average premium for family coverage in California has increased by about 9%, or about 3% per year, but this does not represent a statistically significant change.

Company size: In California, the average family coverage premium contribution for covered workers at small businesses (10 to 199 workers) is much higher than the average for covered workers at large businesses ($9,980 versus $6,374).

Company Features: In California, while average premiums and worker contributions are similar between companies with a high proportion of low-wage workers and those with fewer low-wage workers, the average employer contribution differs. Companies with many low-wage workers contribute less to the cost of family coverage ($21,409 versus $18,001).

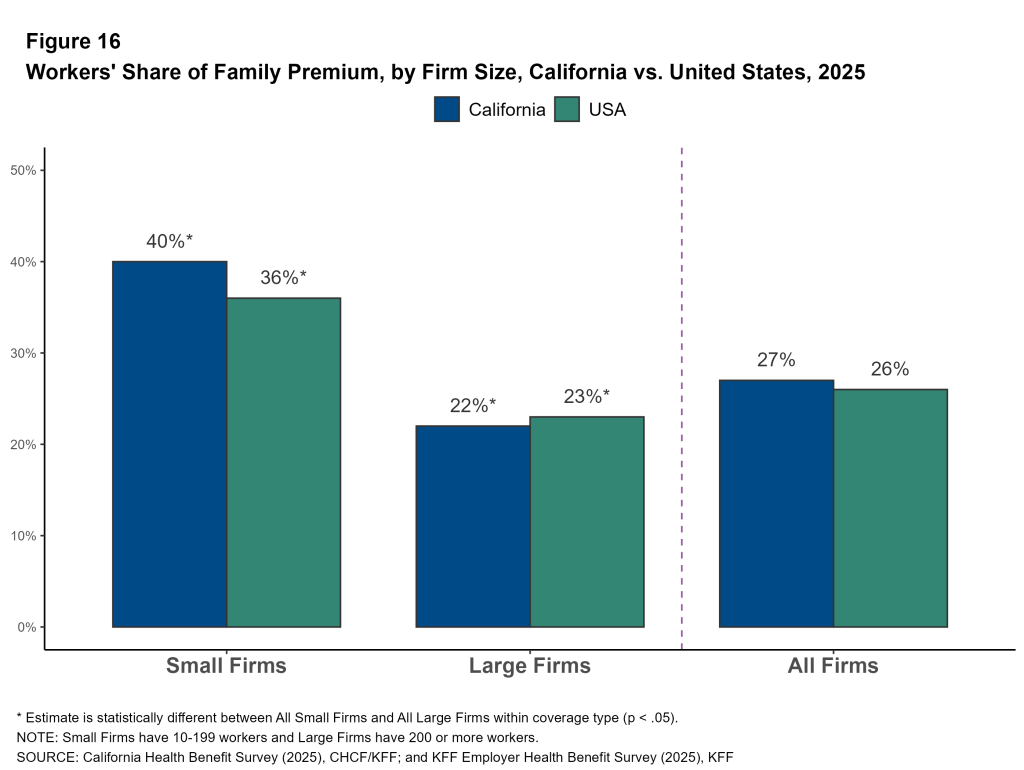

Share of the premium paid by workers: On average, covered workers in California contribute 14% of the premium for individual coverage and 27% of the premium for family coverage, which is similar to national averages.

Company size: Covered workers in California at small businesses contribute a higher percentage of the family premium than those at large businesses, 40% versus 22%.

Share of the premium paid by workers according to the characteristics of the company: The average share of the premium paid directly by covered workers differs across business types in California.

- Covered workers in private, for-profit companies have relatively high average contribution rates for individual coverage (18%) and for family coverage (31%). Workers covered in public companies have relatively low average contribution rates for family coverage (20%). Covered workers at private, nonprofit companies have relatively low average contribution rates for single coverage (5%).

- Covered workers at companies with many higher-wage workers (at least 35% of whom earn $80,000 or more per year) have a lower average premium rate for family coverage than those at companies with a smaller share of higher-wage workers (23% versus 31%).

- Covered workers at companies with at least some union workers have a lower average premium rate for family coverage than those at companies without union workers (20% versus 32%).

Distribution of worker contributions: In California, for single coverage, 47% of covered workers at small businesses are enrolled in no-contribution plans, compared to only 13% of covered workers at large businesses. For family coverage, 35% of workers covered at small businesses are enrolled in plans with worker contributions greater than half the premium, compared to only 5% of workers covered at large businesses.

A greater proportion of covered workers in California are enrolled in a single, no-contribution coverage plan than covered workers nationally (23% vs. 12%). This trend also applies to covered workers at small businesses (13% versus 7%).

Another way to illustrate the high cost of family coverage for some workers is to look at the proportion of workers facing high annual contributions. Many small business workers face significant costs if they choose to enroll dependents. Among companies offering family coverage, 38% of covered workers at small companies are enrolled in a plan with contributions exceeding $10,000, compared to 12% of covered workers at large companies.

:max_bytes(150000):strip_icc()/GettyImages-1425019267-bdfebd075ac2493494f0958300bd7083.jpg?w=390&resize=390,220&ssl=1)

:max_bytes(150000):strip_icc()/VWH-GettyImages-2165530356-f626f8a102124c6687856bd5e79c2b11.jpg?w=390&resize=390,220&ssl=1)